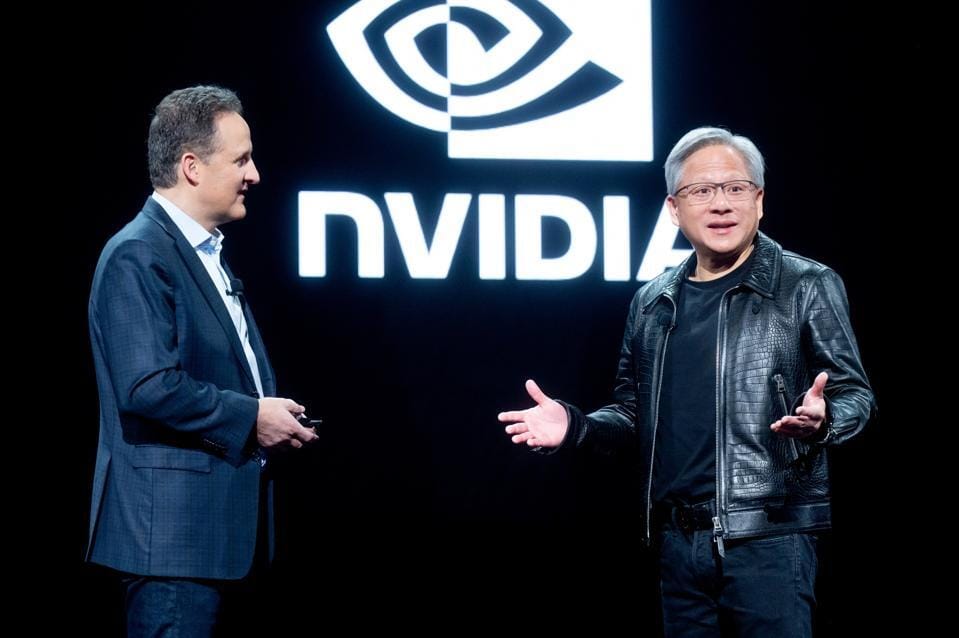

Amazon Web Services (AWS) CEO Adam Selipsky and NVIDIA CEO Jensen Huang, Getty Images for Amazon Web Services

Hey, here’s the real story for today.

Tech stocks hit pause, crypto’s clock is ticking, and the Fed is quietly in the spotlight again. No drama, just data you can use.

Let’s get into it:

Tech Takes a Breather as Yield Anxiety Spikes

Summary: Tech stocks paused today as U.S. bond yields and the dollar dipped. Investors are holding their breath ahead of major earnings and the Fed’s pre-meeting blackout.

Why it matters: Despite noise around Powell’s independence, markets are still pricing in rate cuts. Risky move, tomorrow’s CPI is the real test.

Nvidia Still Riding the AI Wave (But Watch the Chips)

Summary: Nvidia slipped 2.6% on profit-taking after topping $4 trillion last week. Analysts say it’s a breather, not a breakdown.

Why it matters: A potential U.S.–China chip waiver could reopen a massive growth channel. The dip might just be the setup for the next leg.

Fed Tensions Still Brewing

Summary: Trump called Powell a “numbskull” and hinted at firing him — again. But traders haven’t shifted their rate cut bets... yet.

Why it matters: Fed drama adds volatility, but CPI data tomorrow could shake up the whole market narrative.See Today’s Market Breakdown