market check

The market has a case of the Mondays. It's giving mixed signals right now.

⚪ S&P 500: Flat (+0.05%). Just existing.

🔴 Dow Jones: Down bad (-0.30%). Boomer stocks are tired.

🟢 Nasdaq: Main character energy (+0.55%). Tech is trying to carry the whole team on its back.

⚪ Bitcoin: $97,800. Still just vibing under that big 100k resistance.

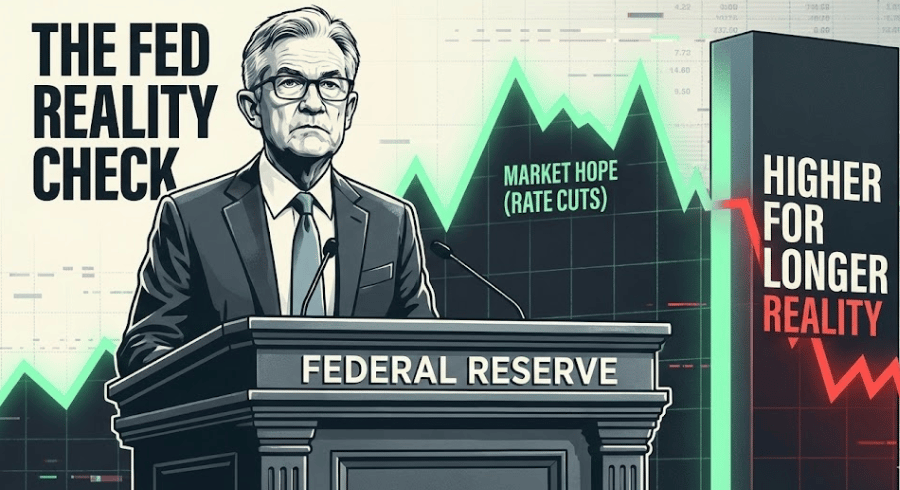

the main character: Papa Powell Spoke

The market’s hope for an early interest rate cut just took a hit.

What Happened: Fed Chair Jerome Powell spoke this morning and maintained a strict "higher for longer" stance. Despite some cooling inflation data, the Fed isn't convinced the job is done.

Why It Matters: The market has been rallying on the assumption that cheap money (rate cuts) is around the corner. Powell essentially poured cold water on that theory. When rates stay high, it squeezes corporate margins and makes borrowing expensive for everyone—from Apple to the homebuyer.

The Take: The algo-traders are overreacting to the tone, selling off on the headline. But look at the data, not the speech. Inflation is coming down. This volatility is noise; the long-term trend remains intact. Don't panic sell your quality assets because of a press conference.

…on our radar

Tesla (TSLA): Trading 3% higher pre-market. Volume is spiking on renewed robotaxi speculation. Watch the $350 level—if it breaks that, we could see a run.

Oil Prices: Continued weakness. Crude is down another 1.5% as global demand forecasts get cut. Good for inflation, bad for energy stocks.

university

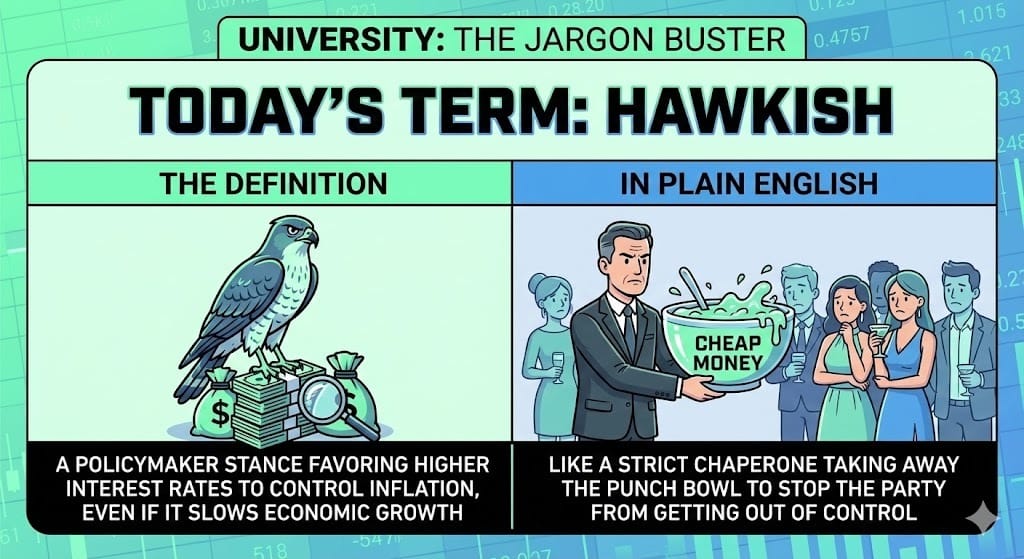

Today's Term: "Hawkish"

The Definition: A stance by a policymaker (like the Fed) that favors higher interest rates to keep inflation in check, even if it slows down economic growth.

In Plain English: Being "Hawkish" is like a strict chaperone at a party. They take away the punch bowl (cheap money) to stop things from getting out of control, even if it ruins the vibe for a bit.

A quick word from our friend,

Investors see ANOTHER return on Masterworks (!!!)

That’s 3 sales this quarter. 26 sales total.

And the performance?

14.6%, 17.6%, and 17.8% → The three most representative annualized net returns.

(See all 26 at Masterworks.com)

Masterworks is the biggest platform for investing in an asset class that hasn’t moved in lockstep with the S&P 500 since ‘95.

In fact, the market segment they target outpaced the S&P overall in that time frame.*

Not private equity or real estate… It’s contemporary and post war art. Crazy, right?

Masterworks investors are typically high net worth, but the point is that you don’t need to be a capital-B BILLIONAIRE to invest in high-caliber art anymore.

Banksy. Basquiat. Picasso and more.

80+ of the world’s most attractive artists have been featured.

511+ artworks offered

$67.5mm paid out as of December 2025

$2.3mm+ average offering size

Looking to update your investment portfolio before 2026?

*Masterworks data. Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

until tomorrow,

Stock Saver